The Pros of Affordable Housing are its affordable rent, stability and fewer evictions, more disposable income for renters, included expenses in rent, and increased liquidity due to lower down payment requirements.

The Cons of Affordable Housing are often less desirable locations, higher costs and maintenance for single-family homes, appreciation restrictions, debt limits on housing payments, and potential overconcentration of low-income residents affecting local job markets.

Takeaways:

- Affordable housing initiatives are crucial for reducing homelessness and aiding economic disadvantaged groups while boosting local economies.

- Critics of affordable housing argue about the fiscal impact on taxpayers, potential crime rate increase, and long waits for housing.

- The importance of affordable housing transcends its physical structure, impacting society at large and necessitating in-depth analysis.

- Affordable housing not only creates job opportunities and stimulates the economy, but also addresses social issues like homelessness and inclusivity.

Affordable Housing in the U.S.: Quick Facts & Insights

Public Perception & Comparisons:

- Perceived Problem (October 2021): 49% of Americans stated affordable housing availability was a major problem, a 10% increase from early 2018.

- Generational Comparison (2021): 70% believed young adults have a harder time buying homes compared to their parents’ generation.

Market Dynamics:

- Active Housing Listings (January 2022): Only 408,922 listings, a 60% decrease from 1 million in February 2020.

- Median Sale Price Increase: From $327,100 in Q4 2019 to $408,100 in Q4 2021, a 25% jump.

Vacancy Rates & Homeownership:

- Rental Unit Vacancy Rate: Dropped from 10% in 2010 to 5.6% in 2021.

- Homeowner Unit Vacancy Rate: Decreased from 2.6% in 2010 to 0.9% in 2021.

- Increase in Homeowners: 2.1 million more homeowners in Q4 2020 compared to a year earlier.

Housing Burden & Affordability:

- Household Burden (2021): Nearly 22 million American households burdened by housing costs.

- Homeownership Barriers: More than a third of renters in 2022 didn’t own a home due to affordability issues.

- Affordable Rental Home Shortage: Shortage of 7.3 million affordable rental homes for extremely low-income renters, an 8% increase from 6.8 million in 2019.

Sources:

- Housing affordability in the U.S.: Key facts – Pew Research Center

- U.S. affordable housing – statistics & facts – Statista

- Addressing America’s Affordable Housing Crisis – Urban Institute

- Public Housing Statistics – iPropertyManagement.com

- Homeownership & Renting – Pew Research Center

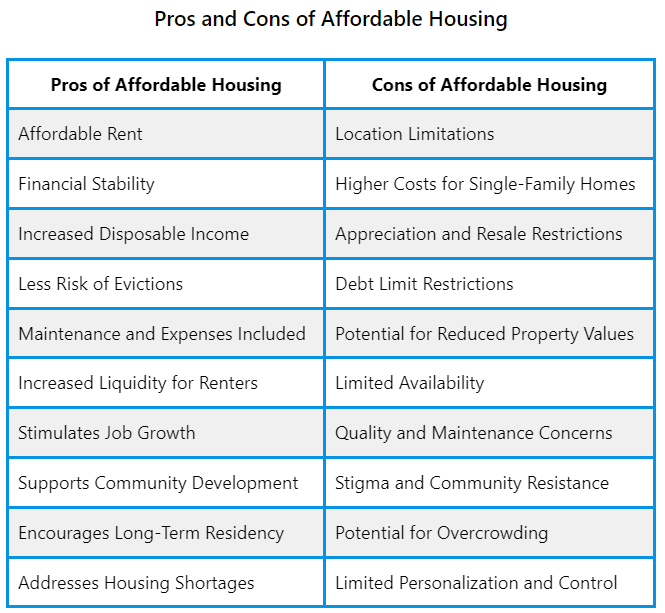

| Pros of Affordable Housing | Cons of Affordable Housing |

|---|---|

| Affordable Rent | Location Limitations |

| Financial Stability | Higher Costs for Single-Family Homes |

| Increased Disposable Income | Appreciation and Resale Restrictions |

| Less Risk of Evictions | Debt Limit Restrictions |

| Maintenance and Expenses Included | Potential for Reduced Property Values |

| Increased Liquidity for Renters | Limited Availability |

| Stimulates Job Growth | Quality and Maintenance Concerns |

| Supports Community Development | Stigma and Community Resistance |

| Encourages Long-Term Residency | Potential for Overcrowding |

| Addresses Housing Shortages | Limited Personalization and Control |

Pros of Affordable Housing

- Affordable Rent: Affordable housing offers rents significantly lower than market rates, which is crucial for individuals and families with limited income. This affordability ensures that a larger portion of the population can access safe and decent housing without stretching their budgets too thin. For example, in areas where the median sale price for homes has spiked, affordable housing becomes a critical option for those who can’t keep pace with the rising costs.

- Financial Stability: By providing stable and predictable housing costs, affordable housing contributes to the financial stability of its occupants. This stability is essential for budgeting and planning, especially for low-income families who might otherwise face the uncertainty of fluctuating rental markets. This aspect is particularly important in the context of rising home prices and rental rates, as it shields occupants from market volatility.

- Increased Disposable Income: Occupants of affordable housing often have more disposable income due to lower housing costs. This extra income can be spent in local economies, supporting businesses and services in the community. It’s a positive cycle: as individuals save on rent, they can invest in other areas of their life, thereby stimulating economic activity in their neighborhoods.

- Less Risk of Evictions: Affordable housing policies typically include measures that protect tenants from frequent or unjust evictions. This offers a more secure living environment, especially for families and vulnerable populations. In contrast to the high eviction rates in market-rate rentals, affordable housing provides a level of security that can be life-changing for many.

- Maintenance and Expenses Included: Often in affordable housing, maintenance fees and property taxes are included in the rent, relieving tenants of unexpected or burdensome costs. This inclusion is particularly beneficial for individuals who may not have the financial flexibility to handle sudden expenses, ensuring that their housing remains safe and well-maintained.

- Increased Liquidity for Renters: Affordable housing allows renters to avoid large down payments and the financial constraints of homeownership, leading to greater liquidity. This liquidity can be particularly important for individuals who may need to relocate for work or family reasons, offering them the flexibility that owning a home does not.

- Stimulates Job Growth: Affordable housing can lead to job growth in communities. People are more likely to take jobs they might not otherwise consider if they have access to affordable housing, as the burden of high rent is lessened. This can lead to a more dynamic and adaptable workforce, beneficial for local economies.

- Supports Community Development: Affordable housing can play a role in revitalizing neighborhoods and supporting community development. By ensuring that housing remains accessible to a diverse population, these communities can maintain a vibrant mix of residents, which is beneficial for social and cultural dynamism.

- Encourages Long-Term Residency: Affordable housing often leads to longer-term residency, as people are less likely to move frequently when their housing costs are manageable. This stability can result in stronger community ties and a greater sense of belonging among residents.

- Addresses Housing Shortages: The provision of affordable housing is a direct response to the shortage of accessible and reasonably priced homes in many regions. With the growing gap between income levels and housing costs, affordable housing plays a crucial role in ensuring that more people can find suitable and secure housing.

Cons of Affordable Housing

- Location Limitations: Many affordable housing projects are developed in areas lacking basic amenities due to lower land costs. These locations might be far from job centers, schools, and healthcare facilities, impacting the quality of life for residents. This can result in longer commutes and limited access to essential services.

- Higher Costs for Single-Family Homes: In affordable housing schemes, single-family homes can be more expensive than apartments in terms of maintenance and upkeep. This can put a financial strain on families who prefer or need single-family housing but find it challenging to manage the associated costs.

- Appreciation and Resale Restrictions: Affordable housing properties often come with limitations on appreciation and resale. For example, a cap of 3.5% per year on appreciation and the requirement to sell only to qualified buyers can limit the potential financial benefits of homeownership and may deter some from investing in such properties.

- Debt Limit Restrictions: Affordable housing programs often have strict limits on the amount of debt residents can carry relative to their income. While this is intended to ensure affordability, it can also limit housing options for individuals with higher debt levels, even if those debts are manageable.

- Potential for Reduced Property Values: In some cases, the development of affordable housing can be perceived as having a negative impact on nearby property values. This perception, whether accurate or not, can lead to resistance from existing residents and complicate efforts to expand affordable housing options.

- Limited Availability: Despite the need, there is often a significant shortage of affordable housing units available. This scarcity can lead to long waiting lists and a lack of options for those in urgent need of housing, exacerbating the problem of homelessness and housing instability.

- Quality and Maintenance Concerns: In some instances, affordable housing units may suffer from quality and maintenance issues. Limited funding for these projects can result in compromises in construction and upkeep, potentially leading to less desirable living conditions for residents.

- Stigma and Community Resistance: Affordable housing developments can sometimes face stigma and resistance from communities. Misconceptions about affordable housing and its residents can lead to NIMBY (Not In My Back Yard) attitudes, hindering the development of new projects and integration into communities.

- Potential for Overcrowding: Affordable housing units, particularly in high-demand areas, can become overcrowded as families and individuals struggle to find affordable options. This overcrowding can lead to issues like increased wear and tear on the property and strained communal resources.

- Limited Personalization and Control: Residents in affordable housing often have less control over their living space compared to homeowners. Restrictions on modifications, renovations, or even personalization can make it challenging for residents to feel fully at home or express their individuality through their living environment.

Defining Affordable Housing

Affordable housing refers to residential units that are financially accessible to individuals or families, with costs not exceeding 30% of their household income. This benchmark aligns with the Department of Housing and Urban Development’s (HUD) 30% rule, which considers housing costs above this threshold as burdensome. Affordable housing encompasses a variety of living arrangements, from government-subsidized housing to privately-owned homes that offer lower rents due to housing vouchers or other federal funding mechanisms.

Securing a low-income housing unit typically involves an application process through local housing authorities, including the provision of proof of income to demonstrate eligibility. This type of housing is intended for households earning below 80% of the median income of the local area, as defined by HUD guidelines. While low-income housing is often rented directly from public housing authorities, affordable housing can be found in the private market, where landlords accept housing vouchers as part of the rent payment.

The distinction between low-income and affordable housing is crucial, as the former is more strictly regulated and targeted toward the most economically disadvantaged populations, whereas the latter can serve a broader range of incomes, reflecting a diverse demand for more cost-effective living options.

Economic Benefits Explored

The development of affordable housing projects can act as a catalyst for local economic stimulation. By creating a demand for various construction-related jobs, these initiatives can significantly contribute to job creation and economic diversification.

Furthermore, the availability of cheaper housing units can lead to a more balanced real estate market, with potential benefits for both consumers and developers.

Stimulates Local Economies

By bolstering spending power and fostering job creation, affordable housing serves as a catalyst for local economic vitality. Construction and ongoing maintenance create a multitude of jobs, while stable, lower housing costs allow residents to spend more within their community, supporting local businesses. Furthermore, the presence of affordable housing can attract new businesses, enhancing the overall economic landscape.

Here’s a glance at how affordable housing stimulates local economies:

| Economic Impact | Description |

|---|---|

| Job Creation | Construction and maintenance jobs increase employment opportunities. |

| Consumer Spending | Residents have more disposable income to spend locally. |

| Infrastructure Improvement | Neighborhoods are revitalized, increasing property values. |

| Business Attraction | Affordable living options draw businesses and foster investment. |

| Investment Opportunities | Incentives for investors and developers spur housing market growth. |

Job Creation Impact

Significant employment opportunities arise from the construction and maintenance phases inherent in affordable housing initiatives, fueling local economies and supporting various sectors.

The real estate and construction industries, in particular, experience a boost in job availability as new projects commence. Additionally, the demand for goods and services increases, benefiting suppliers and creating a multiplier effect across the economy.

The ongoing need for property management and related services ensures a continuous supply of jobs. Moreover, as affordable housing improves individuals’ financial stability by reducing housing costs, there is potential for enhanced consumer spending.

This additional disposable income can lead to further economic growth within the community, illustrating the symbiotic relationship between affordable housing and job creation.

Social Implications Considered

Understanding the social implications of affordable housing helps illuminate its role in fostering community stability and individual well-being. It is not merely a matter of providing shelter; it’s about ensuring that all members of society have access to a secure and dignified living environment. Affordable housing serves as a cornerstone for a functioning community by addressing vital socioeconomic concerns.

Here are some of the key social implications of affordable housing:

- Reduction in Housing Insecurity: Affordable housing mitigates the risk of homelessness by providing options for renters to cope with escalating rents, thereby contributing to the overall stability of the community.

- Enhanced Standard of Living: By aligning housing costs to be no more than 30% of a household’s income, affordable housing enables individuals and families to maintain a respectable standard of living, ensuring that they are not overburdened by housing expenses.

- Greater Disposable Income: The cap on housing expenses allows for better budget management, leading to increased disposable income which can be allocated towards healthcare, education, and savings, thereby improving quality of life.

Income-restricted programs cater to the varying needs across the financial spectrum, while the involvement of private landlords in accepting housing vouchers ensures a mix of housing choices. This integrated approach promotes social cohesion and encourages a more inclusive society.

Potential Quality Concerns

While affordable housing plays a crucial role in alleviating financial burdens, it often raises concerns regarding the quality and availability of essential amenities, particularly in less accessible locations. These projects, typically situated on the outskirts of urban centers, may offer housing at lower costs but frequently come at the expense of smaller living spaces and a lack of basic social infrastructure. The trade-off for affordability can mean that residents have to compromise on amenities that are standard in more centrally located housing developments.

Furthermore, affordable housing units in remote areas might face low absorption rates. Despite a high demand for affordable housing, potential buyers are sometimes hesitant to commit to properties that are far from city centers and job opportunities. This slows down the market, affecting both sales and occupancy rates.

The challenge for developers and policymakers is to balance cost-effectiveness with the provision of basic amenities and services. Establishing affordable housing in areas without sufficient access to schools, healthcare, and public transportation can significantly diminish the quality of life for residents. Therefore, careful planning and investment in social infrastructure are essential to ensure that affordable housing is not only accessible but also livable.

Community Impact Analysis

Acknowledging the potential quality concerns raised by affordable housing, it is equally important to examine its broader effects through Community Impact Analysis. This thorough assessment provides a multifaceted view of how affordable housing projects influence the local community, extending beyond the immediate benefits to potential residents. It is a vital tool for policymakers, developers, and the community at large to make informed decisions.

When conducting a Community Impact Analysis, several key areas are scrutinized:

- Economic Effects: Affordable housing can stimulate local economies by increasing consumer spending and potentially attracting businesses that cater to the new residents.

- Infrastructure and Services: The analysis evaluates whether existing infrastructure can support the additional population without causing undue strain. This includes assessing the capacity of schools, transportation systems, and healthcare facilities.

- Social Implications: It considers the impact on social dynamics, such as the promotion of diversity and inclusion within the community, while also highlighting any potential for increased demand on social services.

Financial Challenges Highlighted

The provision of affordable housing presents significant financial challenges. This is especially true when considering budgetary limitations and the accessibility of funds. These constraints often manifest in the form of reduced availability of resources for the development and maintenance of affordable housing projects. Furthermore, the complexities in securing funding can lead to delays and additional costs. These factors exacerbate the challenges faced by both developers and prospective residents.

Budget Constraints Impact

Grasping the nuances of budget constraints reveals their profound impact on the financial stability of individuals seeking affordable housing. The struggle is multifaceted, as low-income households strive to find a balance between housing costs and other living expenses. These constraints often lead to difficult financial decisions and can have a ripple effect on overall well-being.

Here are key issues associated with budget constraints in affordable housing:

- Limited financial flexibility can make it difficult to cope with rent increases and shifts in the housing market.

- Households may face challenges in staying below the 30% income threshold deemed affordable, leading to housing stress.

- Qualifying for income-restricted housing programs becomes more difficult under tight budget constraints, restricting access to much-needed support.

Funding Accessibility Issues

Significant challenges in funding accessibility severely hinder the development and distribution of affordable housing initiatives. The struggle to secure adequate federal funds through housing vouchers is a key issue, directly impacting the number of low-income families who can access affordable homes. Limited financial resources and stringent qualification criteria present barriers that prevent many from participating in housing programs. This is compounded by the overwhelming demand for cost-effective living spaces, which the current funding levels are unable to meet.

Developers, too, face their own set of financial hurdles. The construction or refurbishment of properties into affordable housing is often stymied by economic constraints. Without sufficient funding pathways, the prospect of increasing the affordable housing stock remains a significant challenge, leaving developers and potential residents alike in a precarious situation.

Long-Term Sustainability Debate

Amidst the quest for affordable housing solutions, the long-term sustainability of inclusionary housing programs remains a contentious issue, fueling debate among policymakers and industry stakeholders.

These programs, designed to integrate affordable units into new market-rate developments, have sparked a complex dialogue on their viability and impact.

Consider the following:

- Regulatory Challenges: Opponents argue that inclusionary housing mandates, which require developers to include affordable units or pay fees, are an overreach of public sector authority. They claim this approach distorts free market dynamics and could deter development, although supporters counter that it’s a necessary measure to ensure diverse communities.

- Economic Viability: The dependence on market-rate development to subsidize affordable housing raises questions about the economic feasibility in fluctuating real estate markets. Skeptics worry that during downturns, the model may fail to deliver the needed affordable units.

- Legal Landscape: Federal court decisions have sometimes limited the scope of inclusionary housing, necessitating careful program design to withstand legal scrutiny. This adds a layer of complexity to implementing programs that are both effective and legally sound.

These points underscore the intricate balance between fostering affordable housing and maintaining a robust housing market.

As such, the sustainability of inclusionary housing programs is an ongoing subject of analysis and evolution.

Conclusion

Affordable housing presents a multifaceted impact on society, balancing economic advantages with potential social and community drawbacks.

Despite the challenges, such housing remains a crucial element in addressing homelessness and economic disparity.

A notable statistic is that for every 100 extremely low-income households, there are only 37 affordable rental homes available, underscoring the urgency and complexity of expanding affordable housing while mitigating its downsides for a more equitable future.